A Tumultuous Day on Dalal Street

The Indian stock market faced a significant downturn today, with the Nifty 50 and BSE Sensex both experiencing sharp declines. This crash is part of a broader global market sell-off driven by mounting fears of a recession in the United States, as well as concerns over the global economic outlook.

Key Indices Plummet

The Nifty 50 dropped by over 2%, while the BSE Sensex fell by more than 1,200 points, marking one of the steepest single-day falls in recent months. The market’s performance reflected the growing anxiety among investors regarding the potential for a prolonged economic slowdown.

Global Factors at Play

Several factors have contributed to the current market turmoil. Key among these is the increasing likelihood of a recession in the U.S., as indicated by recent economic data and projections from major financial institutions like Goldman Sachs. Additionally, global markets have been jittery due to escalating geopolitical tensions and fluctuating commodity prices, especially oil.

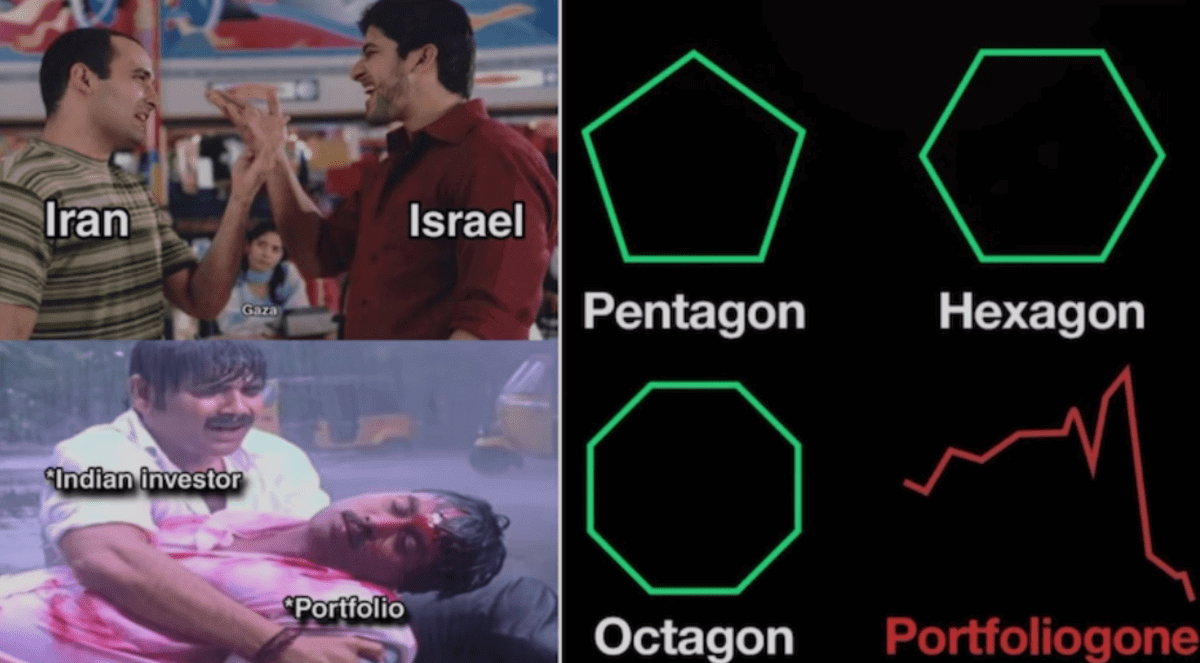

Impact on Indian Investors

Indian investors have not been immune to these global trends. The sell-off has affected various sectors, with banking, IT, and auto stocks taking the hardest hits. Major companies such as Reliance Industries, HDFC Bank, and Infosys saw their stock prices decline significantly.

Expert Opinions

Financial analysts and market experts are advising caution. According to some, the current downturn might offer buying opportunities for long-term investors, while others suggest staying on the sidelines until the market stabilizes. The consensus is that the volatility is likely to persist in the near term.

Sector Analysis

- Banking: The banking sector has been particularly vulnerable, with major banks witnessing sharp declines in their stock prices. Concerns over rising non-performing assets (NPAs) and potential exposure to global financial instability have added to the sector’s woes.

- IT: The IT sector, a significant contributor to the Nifty 50, also faced substantial losses. Companies like TCS and Wipro saw their shares drop amid fears of reduced demand from their key markets in the U.S. and Europe.

- Auto: The automotive sector, already reeling from supply chain disruptions and rising input costs, suffered further as investor sentiment soured. Major auto manufacturers saw their stocks decline, reflecting broader economic uncertainties.

Broader Economic Implications

The stock market crash is not just a reflection of investor sentiment but also a harbinger of potential economic challenges ahead. A prolonged market downturn could impact consumer confidence, reduce corporate investments, and slow down economic growth. The Reserve Bank of India (RBI) may need to consider additional measures to stabilize the market and support the economy.

Government and Regulatory Responses

In response to the market turmoil, the Indian government and regulatory bodies are likely to closely monitor the situation. Measures such as policy adjustments, fiscal stimulus, and regulatory interventions may be on the table to mitigate the impact of the global economic downturn on the Indian market.

Future Outlook

While the current situation appears bleak, some market participants remain cautiously optimistic. They believe that the Indian economy’s underlying fundamentals remain strong and that the market will eventually recover. The key will be how quickly global economic conditions stabilize and how effectively domestic policies can support growth.

Conclusion

The recent crash in the Indian stock market underscores the interconnectedness of global economies and the susceptibility of domestic markets to international developments. Investors and policymakers alike must navigate these turbulent times with prudence and foresight. While challenges abound, opportunities for recovery and growth remain, contingent on effective management of both domestic and global economic factors.

As the situation evolves, it will be crucial for all stakeholders to stay informed and agile, ready to adapt to the changing economic landscape.